New 1099 Rules 2024 Rules – Millions of taxpayers who generate income via online platforms may be receiving Form 1099-K for the first time. . In that case, you wouldn’t receive a 1099 The old rule still applies due to you not meeting the income threshold. What’s more, come 2024, the IRS is only going to phase in the new reporting .

New 1099 Rules 2024 Rules

Source : markjkohler.comIRS delays 1099 K rules for side hustles, ticket resales

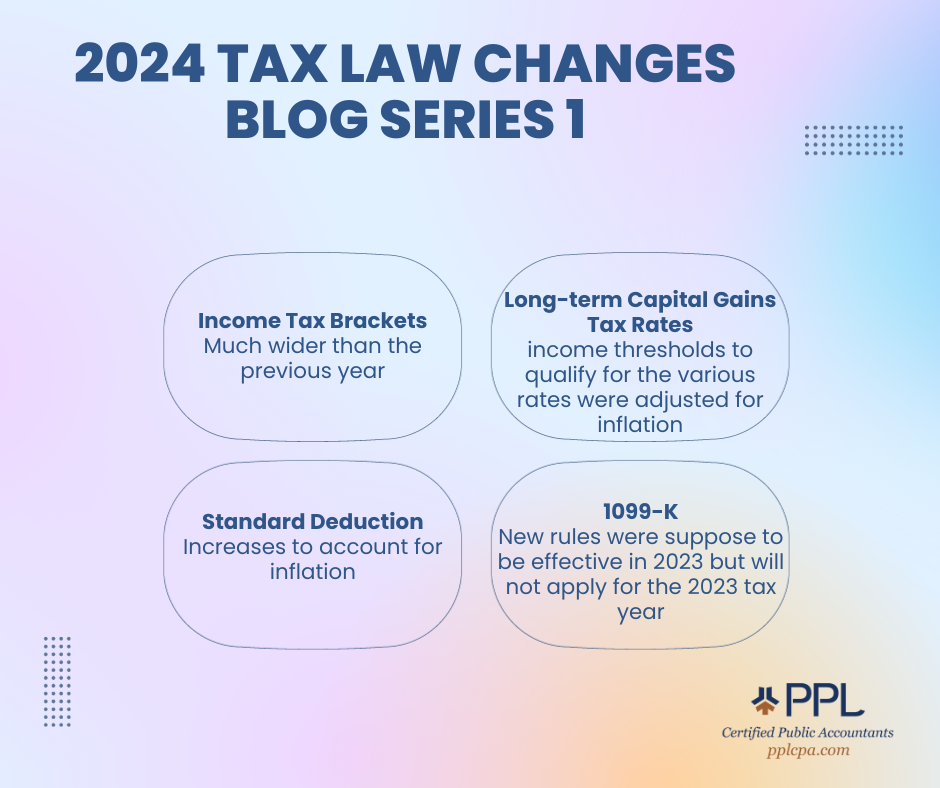

Source : www.usatoday.comBlog Series: Tax Law Changes & Updates for 2023 PPL CPA

Source : www.pplcpa.comIRS delays 1099 K rules for side hustles, ticket resales

Source : www.usatoday.comHow Did Your 1099 Season Go? New E Filing Rules Challenged Some in

Source : www.cpapracticeadvisor.com1099 Rules Business Owners Should Know in 2024

Source : tipalti.comNew tax rules coming for those using mobile payment apps MSU

Source : red.msudenver.edu1099 Rules Business Owners Should Know in 2024

Source : tipalti.comIRS Rules And Laws Change For The 2024 Tax Season – Forbes Advisor

Source : www.forbes.comNew IRS Form 1099 Update 2024 Latest Forms Rules And Reporting

Source : medium.comNew 1099 Rules 2024 Rules 1099 Rules for Business Owners in 2024 Mark J. Kohler: The proposed regulation would require the reporting of information about non-financed residential real estate sales to legal entities, trusts, and shell companies. . Tax season is in full swing. If you’re waiting on a 1099-K to file your tax return — you may not be getting one. Since the IRS has delayed launching its new 1099-K reporting requirement, .

]]>